Unlocking The Fragrance Opportunity in China

As China’s luxury market slows down overall, many premium and luxury players are increasingly betting on fragrance to deliver growth. And there’s clear room for it, with penetration of only 5% compared to 50% in the US and 42% in Europe. One estimate projects the market to be worth 44 billion yuan by 2028, effectively doubling in five years since 2023, a rate of growth that far outpaces the global average.

Today, China’s top-selling perfumes come from major global brands: Chanel, Hermès, Dior, YSL and Jo Malone London rounded out the top five in Q1-3 of 2024. It makes sense for people to lean on well-known brands in China, when fragrance wearing isn’t widely established as a daily habit. Instead, fragrance has historically been associated with incense and the practices of nobility and the literary class of Ancient China. Its rising popularity today is a microcosm of China’s story of growth and development in recent decades: a luxury previously reserved for the elite, now being taken up by the urban middle class.

Looking ahead, growth and excitement in the category will be driven by China’s youth. The post-90s and post-00s (roughly analogous to younger Millennials and Gen Z) were the first to grow up in China’s prosperous years. They were raised with expectations of success and fulfilment - expectations that have been thwarted by a dampened economic outlook and harsh working culture, but not stamped out completely.

Instead, those expectations have been redirected. Post-90s and -00s still seek meaning and fulfilment, and increasingly look to personal interests and pursuits, health and wellness, sports and the outdoors. They spend emotionally: the top driver to purchase fragrance is ‘to please myself, to enhance my emotional experience’, with 64.2% of fragrance users agreeing.

This is a generation determined to forge their own path. Individuality, expression and meaning are important to China’s youth, making niche brands particularly well placed to take advantage of the opportunity in fragrance. This has not gone unnoticed by major players: Puig is reportedly planning to expand the presence of niche brands like Byredo, Penhaligon’s and L’Artisan Parfumeur across Hong Kong and Macau, while Le Labo has steadily grown its physical presence from Shanghai to Beijing and Chengdu, and in 2023 launched MHYRRE 55 as Shanghai’s City Exclusive.

For fragrance brands making inroads in China, a China-first strategy is key. Brands must adapt global strategy with deep local nuance and specificity to meet cultural and consumer needs in China. Those that don’t are called out - a lot of the time literally by the country’s socially driven and digitally active youth.

The opportunity for niche fragrances in China is huge, but it won’t be easy to unlock – not only do younger generations set a high bar for brands, the market also has a thriving homegrown scene for niche fragrances. Brands like To Summer, Melt Season and DOCUMENTS are China-first by default, and tap into Chinese cultural tradition in subtle, sophisticated ways that speak to the patriotism of China’s post-90s and -00s. Also appealing to desires for individuality, expression and meaning, they’re in direct competition with global niche fragrance brands - and as investments from L’Oréal, Estée Lauder Companies and Puig in To Summer, Melt Season and Scent Library show, these competitors are worth taking seriously.

So - how can global fragrance brands, niche or not, unlock growth in China? What does ‘China-first’ really mean today and in this context?

We looked at some of China’s fragrance brands to see how they’re driving cultural resonance in their home market - and what global brands can learn from them.

TREAT FRAGRANCE AS AN INWARD PURSUIT

L-R: Book Pavilion activation by To Summer; Melt Season’s Shenzhen Luohu store; ceramic diffuser by DOCUMENTS

Traditionally, global brands view fragrance as part of beauty; in China, it’s equally useful to think of fragrance within the home category. Here, fragrance wearing is a more inward pursuit, acting as a small touch that improves your immediate, personal surroundings. As indicated by the main driver to ‘please myself, enhance my emotional experience’, it’s about the wearer (vs. those around them) being able to experience and enjoy the scent throughout the day, as a means to sensory comfort, pleasure, stimulation and so on.

To Summer and Melt Season reflect the idea of fragrance as an inward pursuit with soft, cocooned, meditative retail design. Last year, To Summer’s Book Pavilion activation in Beijing was inspired by one of the Emperor’s study halls in the Forbidden City, combining fragrance with opportunities to try slow crafts and pursuits like traditional bookbinding and Chinese chess. It’s also no surprise that Chinese fragrance brands are quick to extend into home fragrance, with incense, candles and diffusers.

KEY TAKEAWAY: Global brands can learn from their local competitors by embedding fragrance within a lifestyle of wellness and slow, soft living. Emphasise the sensory experience for the wearer and activate with pursuits that form part of this lifestyle - yoga, crafts, traditional Chinese medicine (TCM) massage and other related, trending activities.

ENCOURAGE OPEN EXPLORATION WITHOUT RULES

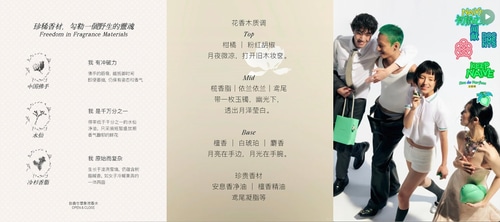

L-R: To Summer blends floral, woody and creamy notes in Her; fragrance notes from To Summer’s Jade; DOCUMENT’s social campaign for Naive

Being less established in China, fragrance is much less bound by the rules and traditions of the category. While Chinese brands reference the five fragrance families, they don’t sort their scents between them categorically. Nor are fragrances strictly divided into feminine and masculine - the creative surrounding perfumes often feature men and women, like DOCUMENTS’ summer campaign for Naive above, calling for everyone to tap into the energy of their youth. According to DSM-Firmenich's Luc Berriet, in a blind test with male consumers in China, all of their favourite scents were traditionally feminine.

Rather than the usual categories, Chinese fragrance relies on deep and evocative storytelling to help audiences navigate range. To Summer’s fragrance notes read like poetry, taking readers on a journey from top notes (‘The soft cool of a moonlit night; open the old wooden dressing table’), through mid notes (‘Wearing a jade bracelet under the dim light, gleaming with the brightness of moonlight’), to base notes (‘The moon by your hand; the moonlight on your wrist’). Like this, China’s individuality-seeking youth are free to explore fragrance for themselves, on their own terms, without expectations of what they ‘should’ like or smell like. It’s simply about what speaks to them, as an individual.

KEY TAKEAWAY: Strategically, global brands looking to win with China’s youth should reframe the way they think about their portfolio. Rather than gender and fragrance family, think how you might delineate your range by the values they represent in order to allow a Chinese audience to explore openly.

PLATFORM CHINESE SCENTS & TRADITIONS TO THE WORLD

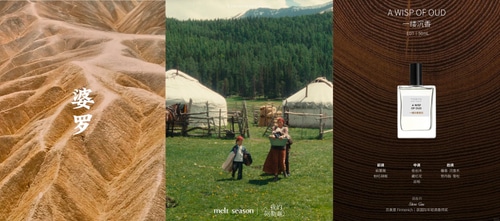

L-R: ZHIWUZHI’s Poluo; Melt Season’s Roaming Wind; Scent Library’s A Wisp of Oud

As Chinese brands look to tap into youth culture and the national pride of younger generations, fragrance becomes a way to explore and deepen engagement with Chinese cultural tradition. China’s rich cultural heritage and diverse regional identities offer endless possibilities from which brands can draw inspiration. From Melt Season’s evocation of nomadic life in Roaming Wind and ZHIWUZHI’s echoes of Buddhist ritual in Poluo, to the childhood nostalgia of Scent Library’s L.B.K. (the scent of clean, fresh water boiling in an aluminium kettle) and Milk Candy (inspired by White Rabbit sweets) we see Chinese brands tapping into their national heritage in myriad ways.

Importantly, these brands are also pioneering the use of Chinese fragrance notes in their perfumes. Chinese florals are often used to suggest connection to certain seasons, such as osmanthus and autumn. Agarwood is another Chinese note, coming from the same Aquilaria tree that yields oud, but offering a sweet woodiness associated with incense and TCM. Unsurprisingly, Chinese brands are exerting influence over Chinese tastes: Buddha’s palm fruit is amongst the top 10 most popular fragrance notes in the country.

KEY TAKEAWAY: Of course, global brands can’t tap into China’s cultural tradition with the authenticity of local brands. What they can do is use their global platform to introduce Chinese notes and fragrance to the world. What does it look like to pay homage to Chinese culture in an authentic, nuanced way?

At Al Dente, we’re proud to have partnered with world-class fragrance brands like Diptyque, Gucci, and Prada. Fragrance may be one of the most subjective experiences in the world — yet it also holds universal power. From Chengdu to Paris, it shapes how we feel, express ourselves, and connect with culture. Curious how your brand can resonate in China’s evolving fragrance landscape? Let’s talk: insights@aldenteparis.com.

This Insight was cooked up by Al Dente contributor Zoe Liu.